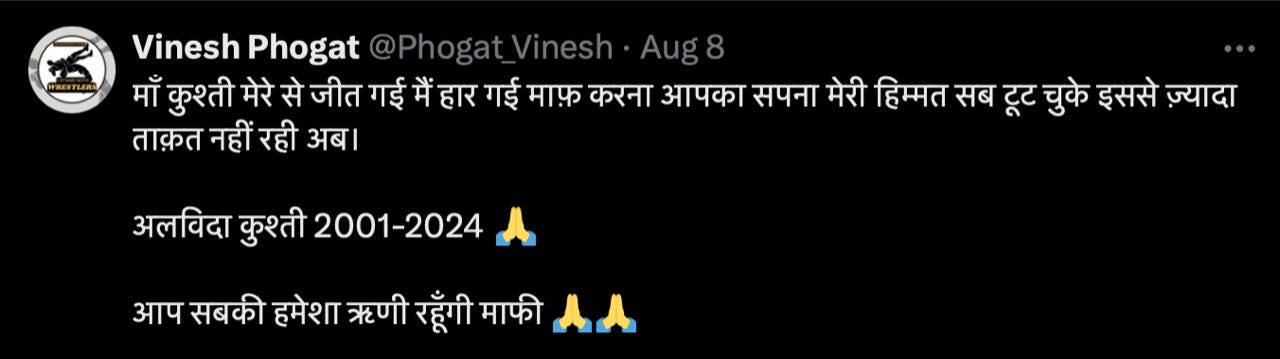

After being disqualified from the Paris Olympics, Vinesh Phogat lost her medal and said bye to her sport forever.

For an Indian to win an Olympic medal is one of the greatest achievements and missing a medal which was (almost) won is a huge setback. Bad luck. But is an Olympic medal so important to accept defeat and withdraw from a sport that was her life ? From 'give it all' to 'give it up'.

A story of Akbar Birbal comes to my mind. Akbar drew a line on paper and asked his courtiers to make it small without erasing any part of it. While other courtiers were confused with this riddle, Birbal the wisest, simply drew a longer line next to the existing one and automatically the existing line became shorter. Contrast used effectively.

Is it not possible for Vinesh to use contrast to reshape her thoughts ?

Start with her birth. For a female to be born alive in Haryana is itself a remarkable measure of good luck. With a state infamous for female foeticide, Vinesh was one amongst the females who lived. That's good luck.

Sex Ratio in Haryana is 879 i.e. for each 1000 male, which is below national average of 940 as per latest census. [Source : Census 2011]

She is educated and playing a sport of her choice. In an alternative scenario, she could have been illiterate, working in farms and tending to cattle. That's more of good luck. She has proudly represented India at the highest level of sport and wears an Indian jersey. This jersey can only be earned and can't be bought no matter the amount of money one may have. Every Indian knows her and respects her like an Olympic medalist. This is all good luck which only one in many hundred million may get.

If she counts 'good luck' in her life and compares it with the 'bad luck' of missing the Olympic medal, the bad luck would fall pale in comparison.

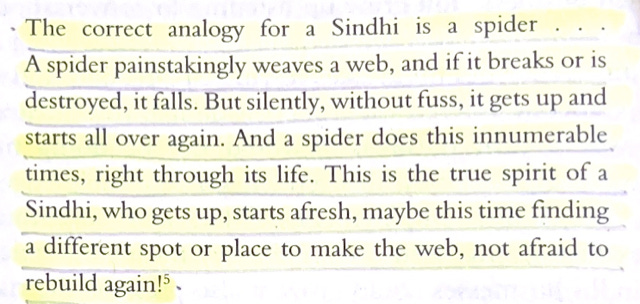

This brings a book to my mind which I read. The Sindhis by Mark-Anthony Falzon

We all know Sindhis are good at making money and loads of it. But one thing that they are better at is more noteworthy : They never give up.

Any setbacks that Sindhi businessmen face are commas in the long story and never full stops.

On similar lines, I remember a story I read about Swami Vivekananda.

Once a young man was depressed over breaking up with his girl friend. Swami Vivekanada told him " Breaking up with a girl friend is bad but losing the confidence to find another one is worse".

In a recent movie 12th Fail, one character which I found even more endearing than the main character was Gauri Bhaiya and his restart tea stall. Gauri Bhaiya had one answer for every setback and failure : Restart.

Connecting all the above, I would say -

Should you ever face a professional or personal setback in your life: set the right contrast , look up to the Sindhis, invoke Swami Vivekananda, listen to Gauri Bhaiya and -

RESTART