I don’t have any holding long or short in the Adani group shares. This note is to talk about shorting in general, my own experience of short selling and finally Buffett’s wisdom on shorting.

Adani Group stocks have been roiled in the last couple of days post the publication of the Hindenburg Report. Hindenburg is a US based short seller specializing in finding companies which it suspects to be fraudulent or having financial irregularities. The research house goes short on these companies, publishes it reports and makes money if the stocks go down.

What is Short Selling?

Normally, when we buy shares of any company, we expect the prices to go up over a period and thus make money. This is known as long investing. Short sellers on the other hand sell shares of the company they don’t have [either by borrowing shares from other owners or selling in the futures market] and buy them back when the price goes down thus making money in the process.

Simply put long investors FIRST buy low and THEN sell high. Short sellers FIRST sell high and THEN buy low.

Perils of short selling

The first danger of short selling is the potential for unlimited losses. In the case of long investing – say you buy a stock at Rs 100. The worst-case scenario is that the stock can go down to zero. So, your maximum loss is pegged at 100. You can’t lose more than what you had invested.

In short selling, the potential for losses is unlimited. Say you short sell a stock at Rs 100. Theoretically, the stock can go up to any price and so can your losses.

The second danger in short selling is absence of staying power. In long investing, one can invest and stay patiently in the position for a long period of time. In short selling, if the position moves against you, you will have to keep pumping more money to cover your losses. The requirement of more money to stay in the game might severely constrain your position and you may have to bow out early [and wounded] even if you are eventually proven right.

Markets can stay irrational longer that you can stay solvent ~ John Maynard Keynes

The third and most lethal danger of short selling is the possibility of a short squeeze. As I wrote earlier, in short selling the intention is to sell high and buy later at a lower price. Imagine you sold some stock at a high price and instead of price going lower, it goes higher and you have losses. You decide to take your losses, lick your wounds, and close out the position. For closing out the position you need to buy back the same quantity of shares which you had sold earlier. When you wish to buy the shares even at a higher price, to your surprise you find that there are no sellers in the market. The stock is locked in upper circuits day after day. The whole thing defies gravity and turns into a vicious loop.

There have been many examples of short squeezes in the capital markets. The one which is etched in my memory is that of Volkswagen. The German billionaire Adolf Merckle, the owner of Porsche tried to take over Volkswagen (VW). Amongst many steps that he took, one was shorting the shares of VW in the market but the tide turned against him and shares of VW kept marching up. With no shares of VW available in the market to cover up, the losses in the position mounted uncontrollably. The monetary and reputational loss was so high that Mr Merckle took his own life.

It's insane to risk something that you have and do need for something that you don’t have and don’t need- Warren Buffett

My experience of short selling

Soon after I started investing in the year 2004, being largely ignorant about the ways of the market, I took short positions in 2 companies because I found the valuations expensive. However, the prices went up considerably and I received a margin call from my broker. I had to liquidate my savings in the bank to fund the margin and eventually to close out the positions. The time I spent in that position was extremely unpleasant with sleepless nights. Having learnt my lesson that the odds are stacked against the investor in short selling, I decided not to do it again. I behaved like Mark Twain’s cat and haven’t touched the stove since.

All I want to know is where I’m going to die so I’ll never go there- Anonymous Hermit

Buffett on short selling

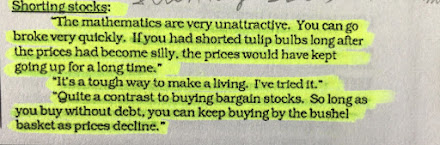

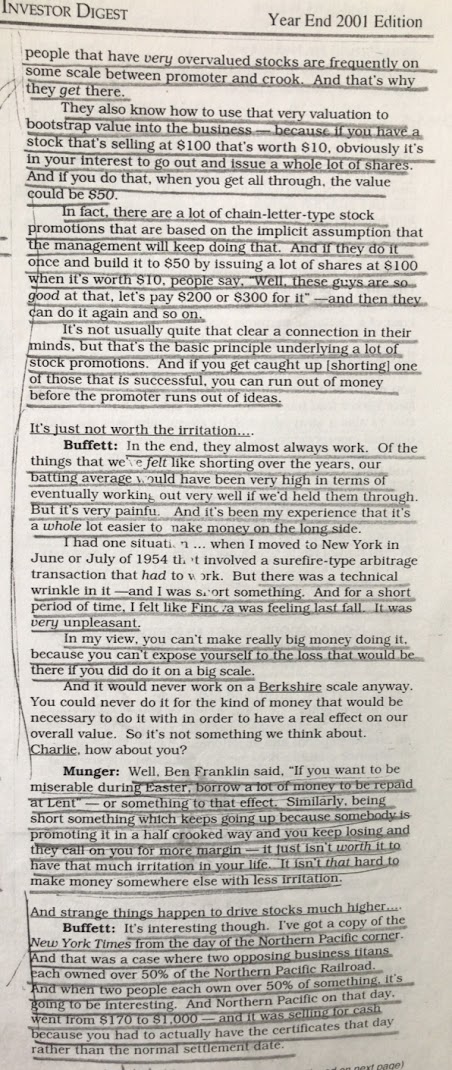

I have kept the best part for the end. I am sure you will relish and learn what Buffett has to say on short selling stocks. Credit for the following excerpts: Outstanding Investor Digest [OID]