In life, risk can come from anywhere. More so, in equity investing. This thought has been captured very well by the following quote :

“Condoms aren’t completely safe. A friend of mine was wearing one and got hit by a bus.” — Robert Rubin

Lakshmi Vilas Bank (LVB) has been in the news for poor functioning and an aborted attempt to merge with Indiabulls. That tells a lot about both. As Yogi Berra said "You can observe a lot by just watching".

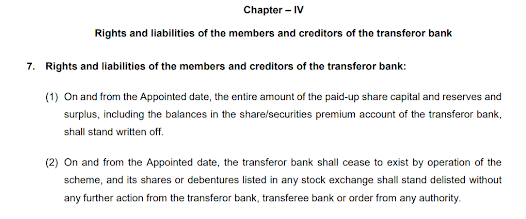

On Nov 17th, RBI put LVB under moratorium and decided to merge the same with DBS India. Merging LVB with a strong entity like DBS would ensure safety of the depositors' money, I think. But what happens to the shareholders ? Read the following :

So, the entire equity capital of LVB stands written off and the shares are now worth zero. Didn't I tell you, that in life, risk can come from anywhere. And more so, in equity investing.

2 comments:

Hi Ankur - Great post on risk management!

History repeats in this case. Global Trust Bank shares went from 15 to 0 on OBC takeover/merger.

But the funny thing in the market is the LVB shares won't go to zero untill they are delisted. They will settle at a few paisa change value :) Currently. for instance, Uttam Value Steel is slated to be delisted with no compensation to shareholders but they still trade at 20/30 paisa (165 cr mcap, yes) - not sure in what hope?

ritesh

Thanks Ritesh for sharing that.

Post a Comment